inheritance tax changes 2021 uk

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. For gifts of cash the donor would be required to withhold 10 of the gift to pay the tax.

North West Leads Uk Construction Boom Property Investor Investment Property Property

Inheritance tax nil rate band pensions lifetime allowance capital gains tax annual exempt amount frozen until 5 April 2026.

. Lets assume that your estate is worth 400000 and your tax-free threshold is 325000. If you sold property between 6 April 2020 to 26 October 2021 you would have been required to report and pay the CGT within 30 days. Capital gains tax allowance frozen.

Inheritance Tax Rates 2021. Capital gains tax rates and allowances. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax.

The aim is that from 1 January 2022 more than 90 of non-taxpaying estates will no longer have to complete. This measure implements a commitment given in Command Paper Tax Policies and Consultations Spring 2021 CP 404 March 2021 to reduce administrative burdens for those dealing with IHT. Where you live doesnt affect inheritance tax.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. Chartered Legal Executive Kat King discusses the changes that will take affect from 1 st January 2022 and who will be affected by these changes. Stamp duty land tax nil rate band 500000 to 30 June 2021 then 250000 to 30 September 2021 and 125000 thereafter.

Inheritance tax reporting change. The rate increase will apply to. Inheritance tax to be affected by new law arriving in 2021 grandparents may be hit INHERITANCE tax pensions and other financial considerations may be impacted by oncoming divorce law changes.

Starting from 6th April 2022 the lower earnings limit will rise by 31. Recently changes to the tax rules have come. ICAEW technical editor Lindsey Wicks looks at the effects as more than 90 of non-taxpaying estates will no longer have to complete full inheritance tax accounts.

There is no federal inheritance tax but there is a federal estate tax. The residence nil-rate band was due to rise with inflation in April 2021 but both thresholds have been frozen until 2026. The second part of the report is due in 2021.

Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. This is only for properties sold on or after 27 October 2021. Annual allowance of 30000 which cannot be carried forward.

The standard Inheritance Tax rate in the United Kingdom is 40. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the requirements for many Personal Representatives when administering smaller non-taxpaying estates. INHERITANCE TAX IHT is the tax which is charged on an estate of a person who has died.

It still means however that married couples and civil partners can give away up to 1m free of inheritance tax. Inheritance Tax Changes - What You Need To Know. Those living alone will get a lesser fee if they leave their homes behind and go to live with their direct descendants.

In the current tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that. The extension to the previous 2004 regulations to include an updated definition of Excepted. By Rebekah Evans PUBLISHED.

27 October 2021 3 min read Share Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his Autumn Budget on Wednesday. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate. If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate.

Gifts in excess of 30000 would be taxed at 10. Whilst these proposals may look good on the surface the devil is in the detail. INHERITANCE TAX could be set for significant changes which may impact gifts and allowances one expert has suggested ahead of the Budget.

Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks. 0838 Sun Feb 28 2021. However it will be replaced with a 125 Heath and Social Care Levy.

Inheritance rules changes in France 2021. How inheritance tax works. Financial planning for retiring from the UK to France Read More Guide to savings accounts in France.

In addition to the standard rate. Inheritance Tax Changes in 2022. Read an overview of the tax measures in the 2021 budget prepared by the KPMG member firm in the UK.

A recent change to the inheritance rules in France contradicts the EU Succession Regulation and may impact UK and foreign expats in France. Even so the death duty 40 tax charge only relates to the part of an estate that is higher than the threshold. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned property in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania.

15 October 2021 1423. 05 March 2020 1145. Tax-wise estate taxes havent been due on estates worth 325000 so far in this tax year 202122 meaning 40 generally applied.

This amount was tapered starting in 2017 and the last part of that increase is happening in 202021. The Office of Tax Simplification OTS has made some recommendations and proposals to overhaul Inheritance Tax IHT. First it is important to highlight that these changes are good news as they will simplify Inheritance Tax IHT reporting requirements and they will apply to the estates of those who die on or after.

The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed. From 2023 the rate of National Insurance will return to 202122 levels.

However what is charged will be less if you leave behind your home to your direct descendants such as children or grandchildren. Continue reading Inheritance Tax. In 2015 the Chancellor of the Exchequer George Osborne announced a major change in Inheritance tax which added on an extra element for family homes which were left when someone died.

Capital Gains Tax UK changes are coming.

January 2022 Inheritance Tax Changes All You Need To Know Key Business Consultants

Inheritance Tax Latest News Analysis And Comment From The I Paper

Inheritance Tax Threshold Frozen Until 2026 But Why Is Iht Planning Still Important Company News Wollens

Budget Summary 2021 Key Points You Need To Know Budgeting Income Support Business Infographic

Inheritance Tax Planning April 2022 Uk Guide

Tolley S Inheritance Tax 2021 22 Lexisnexis Uk

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

Inheritance Tax Review The Law Society

Will We See A Rise In Inheritance Tax Iht Or A New Wealth Tax

Inheritance Tax Can I Pay For School Fees Out Of Income

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

Will Writing And Inheritance Tax The Law Superstore

Uk Inheritance Tax Scope And Context Arnold Hill

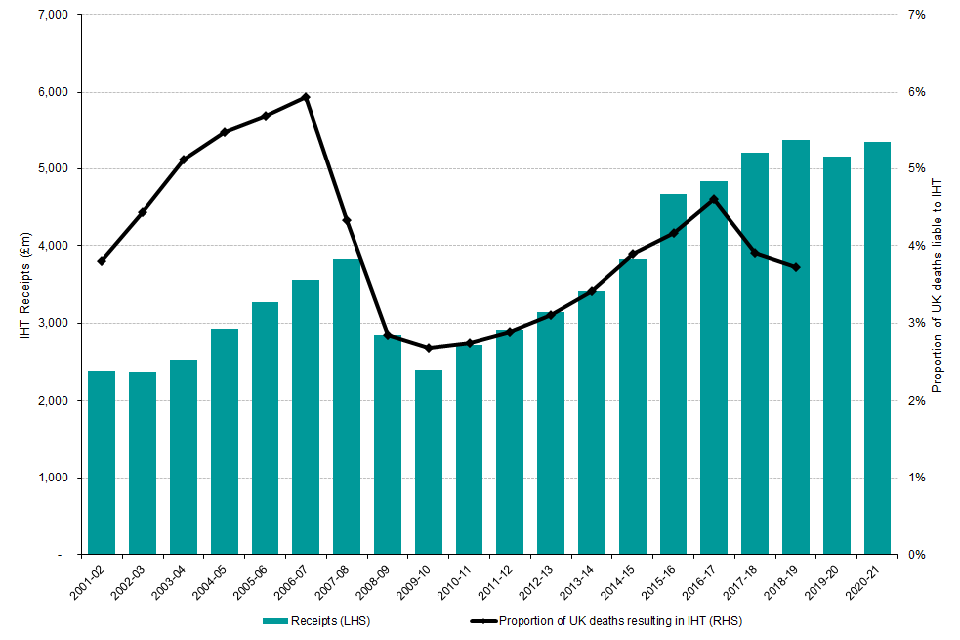

Inheritance Tax Statistics Commentary Gov Uk

8 Tips For Avoiding Inheritance Tax Iht Advice Compare Uk Quotes

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

Sipp Inheritance Tax I Inheriting A Sipp Interactive Investor